My name is Jason, I have a Ph.D. in computer engineering background, thus I am very analytical when it comes to the Stock market. I have been trading since 2011, and have been incredibly successful since 2013. I am probably one of the few traders whose trading returns have beaten the S&P 500 Market since 2013. Over these thirteen years I’ve had over 1000 trades, so it’s clear I have an edge.

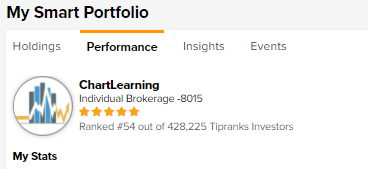

I went ahead and plugged my trading account into TipRanks, from June 2021, I was ranked for that year 54 out of 428k users. I believe this takes into account your return on a position and not monetary value.

My trading system has had a win rate of over 95% since 2016, you can find out more about my impressive win rate when I talk in detail about my stock trading system.

When I first started this blog, I only had the technical charting skills to make profits. However, as a decade passed, I developed the experience to maximize profits and minimize losses. My trading style is strictly chart-based. I try to filter as much news as possible, but I try to stay out of the way of market-moving news events. I have a unique way of reading charts and technical indicators which I've incorporated into a proprietary system.

If you would like to learn more about how I trade and read the market, check out the tag "Stock Market Education" on the blog for many articles that share my insights.

TrendSpider - Use Code CL25 for 25% Off

If you would like to reach me: follow me on X, send me an email, or post a comment below!

About ChartLearning

When I first started this blog, I only had the technical charting skills to make profits. However, as a decade passed, I developed the experience to maximize profits and minimize losses. My trading style is strictly chart-based. I try to filter as much news as possible, but I try to stay out of the way of market-moving news events. I have a unique way of reading charts and technical indicators which I've incorporated into a proprietary system.

If you would like to learn more about how I trade and read the market, check out the tag "Stock Market Education" on the blog for many articles that share my insights.

Support The Site

If you enjoy the content of this website and would like to support it, please check out the few quality products I am affiliated withTrendSpider - Use Code CL25 for 25% Off

If you would like to reach me: follow me on X, send me an email, or post a comment below!