It’s a phrase that almost all traders have heard at least once in their trading journey. Some might have experienced it and quit already, while others have overcome it, and some are probably thinking about quitting now. This post is for traders still struggling to find their path to consistent profitability and for winners trying to maximize their edge even further.

Trading is a field where the odds are stacked against you. It’s your job to choose the right instruments to trade, the right side of the trade, and the right strategy to execute at the right time if you want to stay afloat in the game. Getting so many things right can be difficult for a new trader.

Setting yourself up for success in trading is simply having a strategy or a system with a positive expectancy, in simpler terms, if you trade, you should make money over some time or over a certain number of trades. Some call this having an “edge” in the market.

What Is A Trading Edge?

What does having an “edge” in the market mean? What is an “edge”? An edge is simply having a well-defined, well-tested trading system or a strategy that tilts the scale even if just slightly - in your favor.

From the highest tier of trading - HFTs, institutional traders, etc., - their edge is simple - it’s the speed of execution and speed of information. We (retail traders) can never compete against them. Next tier of traders - small prop firms - their edge? Experience in the market and heavily backtested systems designed by the brightest quants in the field. They, too, are a tough bunch to compete against. Finally, we have retail traders with lots of money and who can read the market accurately purely based on decades of experience. At the bottom, we have new traders with barely any money and no experience.

So… now that we’ve clearly defined what an “edge” is and how far back of the race we are starting. What can we do to create an edge or find an edge of our own?

So… now that we’ve clearly defined what an “edge” is and how far back of the race we are starting. What can we do to create an edge or find an edge of our own?

How To Create An Edge

Let’s start simple: Say, you have just started and you have 10 trades under your belt where you traded based on some simple strategy you derived or learned from.

What’s next? Improve the strategy? - How?

If you are losing money, is it the strategy’s fault? Or your fault? - How to determine this?

Based on the above questions, how can you find your “edge”? The answer to all of these questions is quite simple. In fact, we bet most of you have already done this in a different context many times. Remember studying for tests in university & school? If you did badly on a test, would you simply throw away your answers and go in blindly to the next exam? Or did you analyze your answers, find faults, and re-studied the material in which you thought you were weak?

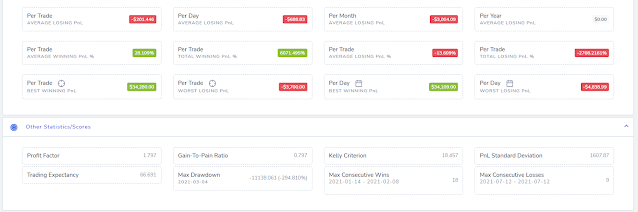

The same concept applies to trading. But a very small number of traders understand this. Here’s a PnL curve of a real trading account for 60 days:

Looking at the graph above, one may wonder, what happened? Why was the performance so inconsistent? Were the initial gains just due to luck? Perhaps favorable and easy market conditions? The answer is simple: this is simply a system with no trading edge.

What’s next? Improve the strategy? - How?

If you are losing money, is it the strategy’s fault? Or your fault? - How to determine this?

Based on the above questions, how can you find your “edge”? The answer to all of these questions is quite simple. In fact, we bet most of you have already done this in a different context many times. Remember studying for tests in university & school? If you did badly on a test, would you simply throw away your answers and go in blindly to the next exam? Or did you analyze your answers, find faults, and re-studied the material in which you thought you were weak?

The same concept applies to trading. But a very small number of traders understand this. Here’s a PnL curve of a real trading account for 60 days:

Always remember: Unless you have a solid, well-tested trading system, no matter how much earn in good market conditions or at the beginning of your trading journal, it’s not a question of “if” you will blow up your account - rather, it’s a question of “WHEN” you will blow up your trading account. Just like in the example above.

How do you go about finding your trading edge in the mess above? The answer, once again, is very simple: use a trading journal or spreadsheet that has enough features to help you figure out all the good and bad parts of your trading.

Here are some of the biggest losing trades the trader in question incurred from the PnL graph above: