Why Greenwich Lifesciences?

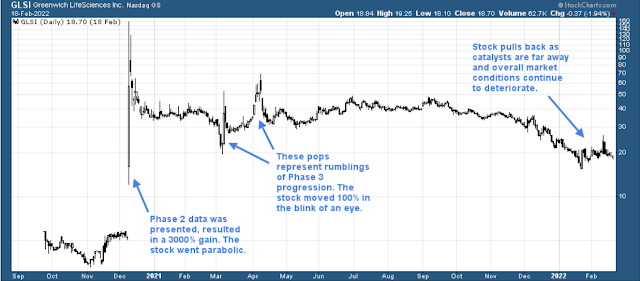

Greenwich Lifesciences ($GLSI) IPOed in September 2020. Since then it has had quite a wild ride. In December 2020 it had an insane one-day move from $5 squeezing to $158. This represents a single-day movement of 3000%. The parabolic movement on the stock was due to its Phase 2 data on its breast cancer immunotherapy drug called GP2. Their drug, GP2 is used in breast cancer patients that have gone into remission. It was designed to prevent a reoccurrence of breast cancer.

The Phase 2 data was impressive, resulting in success in every patient. This meant that during the Phase 2 trial no patient experienced a reoccurrence of breast cancer. Keep in mind that Phase 2 trials often a smaller sample size. In total over 4 clinical trials, 138 cancer patients have been conducted with no serious adverse side effects to GP2 and no reoccurrence of breast cancer.

The next step for the company is to run a much larger Phase 3 trial, which will take years to complete, that effort is already underway. Investors will be able to expect periodic updates from the company as time goes by.

Why Has The Stock Corrected?

Since its meteoric one-day squeeze, it has pulled back. Greenwich Lifesciences has retreated from its highs, for many reasons, which I believe open up a great risk/reward buying scenario.

- The stock squeezed to $185, due to everyone piling on. It was clearly overvalued at this price.

- Current Market conditions have been wrecking many sectors. GLSI is not immune.

- Phase 2 data was a "sell the news" event. The company has a long road ahead, Phase 3 will take years, making the catalyst roadmap, very lengthy, with updates spread far in between.

- FDA placed a hold on the trials, this hold was lifted in July 2022.

Despite what traditional wisdom says, Markets are not efficient. It's quite often the opposite, where the Market tends to become irrationally overbought to irrationally oversold. I believe GLSI is a clear scenario of being irrationally oversold. Eventually, time will correct the price, especially as catalysts are near and milestones are complete (i.e. Start of Phase 3, interim data, etc..)

The Investing Thesis

Now that we have established, what the company's roadmap and pipeline are, as well as why it has corrected so much. I believe buying at these levels will yield a great return for the reasons listed below.

- As previously mentioned results for Phase 2 were incredible, with a 100% success rate. If these results can be replicated in Phase 3, the technology that this company holds will be in a class of its own.

- Phase 3 trials have been fully designed, with many of the details hashed out. Next up is recruiting patients.

- Greenwich Lifesciences has announced a 10 million dollar stock buyback. Buybacks like these only happen when the company is confident in its finances and products. This is a great sign. Note as of 7/12/22 buyback has ended.

- The board has decided to extend the lock-up period for insiders. This affects the company’s directors, officers, and existing pre-IPO investors to hold until March 24, 2023.

- Recent insider buying by higher-ups including the CEO. The CEO just recently purchased 100k in shares in mid-February 2022.

- Possibly a buyout candidate for larger Pharma companies.

The decisions to extend the lockup period, insider buying, and announce a buyback represent strength and confidence. All this points to the company believing they can likely replicate Phase 2 results in Phase 3. This is even more enticing since the stock has currently pulled back severely. This seems like a great risk/reward scenario for those who can stomach the volatility and have the patience.

Fundamentals

Greenwich Lifescience is a relatively new company with no drugs to sell to generate revenue. GP2 will likely be their first product if they can get FDA approval. Only one analyst is covering the stock with a buy rating of $78. Which represents over a 300% increase in the current price. Currently, the SeekingAlpha Quant system gives the stock an "A" in growth. Lastly, due to recent financing as the stock skyrocketed, they took advantage and raised and currently sit on roughly 30 million dollars in cash.

Technical Analysis

I specialize in trading stocks that go parabolic and then crash. That is precisely what Greenwich Lifesciences has done. Parabolic stocks, always correct for a while then go back up. I have shown many examples of this, in the article here.

I have posted the chart below with high notes. What is clear from this chart is:

- The stock went parabolic

- It has pulled back as the majority of parabolic stocks have done. Expect it to run up again towards more solid catalysts (i.e. Phase 3 progression).

- The stock is highly volatile, can move 50% in a matter of days and it can be just considered "noise".

Risks

When trading Biotech companies the number one risk is the drug can fail to meet its trial endpoint, and thus the stock may crater if that occurs. Always keep that in mind when trying Biotech stocks. The rewards can be exponential, but so can the risks.

The risks that can occur when investing in GLSI are:

- Phase 3 is unable to replicate Phase 2 results.

- It will take years for Phase 3 to finish, a lot can happen until then.

- A competitor can come to market first, thus removing the edge GLSI has.

- FDA can ultimately refuse to approve the drug.

Additionally, the stock is low float, meaning very little volume gets traded, so the stock can move big in either direction, without actually ever-changing the trend of the price. It's important to carefully time your entry, as you might overpay.

Conclusion

I believe I have listed a very bullish thesis for investing in Greenwichlife Science if it fits your investing personality. With recent insider buying, an extension of the lock-up period, stock buybacks, and very impressive Phase 2 results. The risk-reward for this stock is perfect for those who can stomach the volatility, and potential worst-case scenario, and have patience.